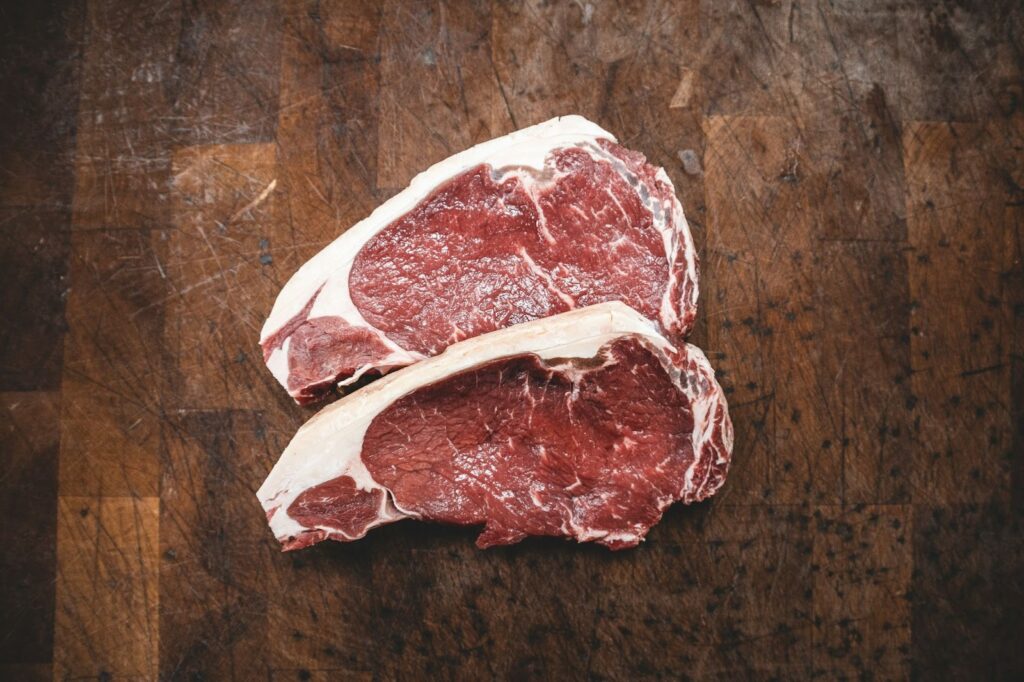

Australian cattle producers are celebrating a monumental shift in international trade, following the near-immediate removal of punitive tariffs on beef exports to the United States. This breakthrough instantly boosts the competitiveness of high-quality Australian meat, with industry analysts estimating billions of dollars in duty savings.

For Queensland’s vast cattle stations, the news delivers confidence and the financial capacity to invest in herd expansion and sustainability. It marks a decisive win for industry bodies who have campaigned tirelessly for fairer global market access, setting the Australian beef sector on a trajectory for unprecedented growth in key overseas markets.

Tariff Relief Drives the Need for Instant Cash Flow via Digital Tools

The abolition of the 10 per cent tariff, which previously applied to billions of dollars’ worth of Australian beef, immediately translates to improved financial margins for exporters. Maximising the benefit of this relief requires the industry to receive payments instantly, moving beyond traditional transaction delays and embracing sophisticated digital solutions to secure rapid cash flow.

At the cutting edge of this digital commerce shift is PayID, an initiative of Australia’s New Payments Platform (NPP) designed to replace complicated BSB and account numbers with a simple, easily recognised identifier. PayID is now ubiquitous across the digital economy, enabling quick transfers for Australian users in myriad contexts. For businesses, a PayID can be a unique identifier like an ABN (Australian Business Number) or ACN (Australian Company Number), while for individuals, it can be an email address or mobile number. These simplified identifiers allow cattle companies, feedlots, and processors to receive payments in near real-time.

The demand for instant settlement is universal in the digital age. For instance, one implementation seeing rapid uptake is through online casino payid withdrawal methods. These platforms leverage the NPP infrastructure to provide users with near-instant access to their funds and winnings, a convenience that has revolutionised digital entertainment. Furthermore, the use of PayID in this context enhances security by eliminating the need to share sensitive bank details with a third party.

These platforms prioritise immediate user access to capital. Indeed, the beef industry benefits enormously from these kinds of real-time settlements for high-value exports. This instant settlement capability drastically improves cash flow management, offering a massive advantage over traditional bank transfers. The use of an ABN or ACN as a PayID also provides an extra layer of confidence, as payers can see the registered business name before confirming the transaction, mitigating the risk of payment fraud or mistaken payments common with large commercial transfers. This assurance and the instantaneous clarity provided by real-time payments allow producers to reconcile accounts faster, secure inventory, and manage payroll without the traditional waiting period, directly turning a trade policy win into immediate operational efficiency.

Diversification and Long-Term Market Security

While the end of the US tariff provides a sudden and substantial boost, the future of Australian beef exports hinges on sustained market diversification and unlocking the long-term potential of other agreements. The Australia-UK Free Trade Agreement (FTA), which entered force in 2023, is strategically important, even though tariff elimination is phased over 10 years.

Under the UK FTA, Australian beef is already benefitting from immediate duty-free quotas, which increase annually. The agreement’s eventual complete removal of tariffs will allow Australian beef to compete on a level playing field with global rivals, ensuring market access resilience against geopolitical or economic shifts. For Queensland producers, this opens a premium, high-value consumer market that appreciates Australia’s stringent quality standards and sustainable production methods.

By strengthening both the long-standing US market and the emerging UK opportunity, Australian exporters mitigate the risks of over-reliance on any single trade partner. This diversification strategy is crucial, particularly given increasing global competition and the need to maximise returns from premium cuts. Industry reports indicate that the combined effect of the US tariff relief and the UK FTA progress provides producers with the confidence to make long-term investments in areas such as genetic improvement, herd health, and drought resilience technologies, cementing Australia’s status as a top-tier global beef supplier.

Producer Reactions and Regional Investment

The positive developments have been enthusiastically welcomed across the country’s beef regions, with industry leaders expressing cautious optimism tempered by an awareness of the persistent challenges posed by fluctuating climate conditions and soaring input costs. Cattle Australia, the peak industry body, called the removal of the 10 per cent duty “a watershed moment,” noting that the savings directly assist in managing the high operational expenses typical of large-scale Australian agriculture. A spokesperson highlighted the importance of translating these trade wins into tangible benefits for regional communities.

The improved margins are expected to drive significant regional investment. Producers are likely to use the enhanced financial stability to focus on achieving net-zero emissions goals and adopting advanced traceability technology, further enhancing Australia’s competitive edge in sustainable beef production.

For regional Queensland, where the beef industry is a pillar of the economy, the confidence injected by the tariff relief creates a positive ripple effect through local services, suppliers, and transport logistics. The clear message is that Australian beef is now more accessible and competitively priced than it has been in years, paving the way for increased export volumes and higher returns across the supply chain.